By Justin Elliott/ProPublica

Three years ago, the Obama administration unleashed its might on behalf of beleaguered American air travelers, filing suit to block a mega-merger between American Airlines and US Airways. The Justice Department laid out a case that went well beyond one merger.

“Increasing consolidation among large airlines has hurt passengers,” the lawsuit said. “The major airlines have copied each other in raising fares, imposing new fees on travelers, reducing or eliminating service on a number of city pairs, and downgrading amenities.”

The Obama administration itself had helped create that reality by approving two previous mergers in the industry, which had seen nine major players shrink to five in a decade. In the lawsuit, the government was effectively admitting it had been wrong. It was now making a stand.

Then a mere three months later, the government stunned observers by backing down.

It announced a settlement that allowed American and US Airways to form the world’s largest airline in exchange for modest concessions that fell far short of addressing the concerns outlined in the lawsuit.

The Justice Department’s abrupt reversal came after the airlines tapped former Obama administration officials and other well-connected Democrats to launch an intense lobbying campaign, the full extent of which has never been reported.

|

They used their pull in the administration, including at the White House, and with a high-level friend at the Justice Department, going over the heads of staff prosecutors. And just days after the suit was announced, the airlines turned to Chicago Mayor Rahm Emanuel, Obama’s first White House chief of staff, to help push back against the Justice Department.

Some lawyers and officials who worked on the American-US Airways case now say they were “appalled” by the decision to settle, as one put it.

“It was a gross miscarriage of justice that that case was dropped and an outrage and an example of how our system should not work,” said Tom Horne, the former state attorney general of Arizona, one of seven states that were co-plaintiffs with the federal government.

As a candidate in 2007, President Obama pledged to “reinvigorate antitrust enforcement,” calling that the “American way to make capitalism work for consumers.” Hillary Clinton has recently made similar promises.

But the reversal in the American-US Airways case was part of what antitrust observers see as a string of disappointing decisions by the Obama administration.

“I hoped they would be much more aggressive and much more concerned about increasing concentration and ongoing predatory conduct,” said Thomas Horton, a former Justice Department antitrust attorney now at University of South Dakota law school. “Too often they really took the business side.”

Obama’s antitrust enforcers have been somewhat more aggressive than the Bush administration in challenging mergers. But that has come in the face of a record-breaking wave of often audacious deals. Nor has the Obama administration brought any major cases challenging companies that abuse their monopoly power. It approved three major airline mergers, for example, leaving four companies in control of more than 80 percent of the market.

In the American-US Airways case, Emanuel emerged as one of the deal’s biggest champions. He was in regular contact with the CEOs and lobbyists for both airlines.

“The combination of American Airlines and US Airways creates a better network than either carrier could build on its own,” Emanuel wrote in an October 2013 letter to the Justice Department that other mayors signed onto. “American’s substantial operations throughout the central United States provide critical coverage where US Airways is underdeveloped.”

The letter was an uncanny echo of the airlines’ arguments – for good reason: It was actually written by an American Airlines lobbyist, e-mails obtained by ProPublica show.

The day after sending the missive, as government lawyers were racing to prepare for trial, Emanuel lunched with the CEOs of American and US Airways at a suite in the St. Regis hotel in Washington. The next stop on his schedule: the White House, for meetings with President Obama and Chief of Staff Denis McDonough. Later that day, Emanuel met with Secretary of Transportation Anthony Foxx, whose agency also had a hand in reviewing the merger. (The White House and Department of Transportation declined to comment on the meetings.)

Meanwhile, the airlines dispatched another valuable asset: An adviser on the deal, Jim Millstein, was both a former high-level Obama administration official at Treasury and a friend of Deputy Attorney General James Cole, the No. 2 at the Justice Department.

Millstein said Cole told him that the government was open to settling the case – a position at odds with the Justice Department’s public stance. The two spoke about the case on social occasions, such as “after finishing a round of golf,” Millstein said in an interview.

The five meetings and phone calls between Millstein and Cole – all within two months in late 2013 – shocked Justice Department staff attorneys who worked on the case, with one describing them as a sign of “raw pressure and political influence.” Cole declined to comment in detail, but said in a statement that “nothing inappropriate occurred.”

As Millstein and Emanuel pressed the administration, the airlines spent $13 million on a phalanx of super-lobbyists, including Heather and Tony Podesta, to marshal support in Washington, records show. Another Democratic lobbyist, Hilary Rosen, also reached out to the White House.

There’s no direct evidence that the lobbying worked. The Justice Department denies the pressure affected its decision-making and the White House said it was not involved. “DOJ enforcement decisions are made independently,” a White House spokesperson said in a statement. “The White House does not play a role in those decisions.”

But the abrupt move to settle was met with a backlash among the team building the case, according to interviews with four lawyers and officials who worked on the case.

“We were astonished,” said an official from one state that joined the federal lawsuit. “They were getting a lot of pressure and all of a sudden they just said, ‘We’re going to walk away from this.'”

Some Justice Department staff attorneys who built the case against the merger were dismayed when they were summoned by a superior to a conference room at the Antitrust Division’s Judiciary Square offices and told the case was done.

“People were upset. The displeasure in the room was palpable,” said one attorney who worked on the case. “The staff was building a really good case and was almost entirely left out of the settlement decision.”

Indeed, government investigators had uncovered documents showing airline executives crowing about how mergers allow them to charge travelers more. “Three successful fare increases – [we were] able to pass along to customers because of consolidation,” wrote Scott Kirby, who became the president of the new American Airlines, in a 2010 internal company presentation.

Economists say it’s difficult to prove definitively effects of a merger, and there’s been no comprehensive study of the American-US Airways deal. Still, there are signs that the concerns the government voiced in its lawsuit have become a reality.

While the price of fuel – one of airlines’ biggest expenses – has plummeted by as much as 70 percent in the last two years, the industry has kept most of those savings for itself. Fares went down by just 4 percent in 2015 as U.S. airlines made record profits of nearly $26 billion. That’s in contrast to Europe, where the industry is significantly less concentrated and there is intense competition.

The combined company, which operates as American Airlines, has steadily increased fees since the deal, one of the harms the Justice Department warned of three years ago. So-called Main Cabin Extra seats, for example, which went for an additional $8 to $159 in 2013, now cost an extra $20 to $280.

Earlier this year, American also eliminated a discount fare program before bringing it back on “selected routes.” The rollback of the program was another thing the government had predicted.

Wall Street has cheered the effects of the deal. A 2014 Goldman Sachs analysis about “dreams of oligopoly” used the American-US Airways merger as an example. Industry consolidation leads to “lower competitive intensity” and greater “pricing power with customers due to reduced choice,” the analysis said.

(In a statement, American Airlines said the merger had “delivered significant benefits to customers, employees and communities” including by creating new flight options. It said it has upgraded its fleet and is “investing $3 billion to improve our customers’ experience in the air and on the ground.”)

In the biggest concession of the settlement, American Airlines had to divest some takeoff and landing rights from Reagan National in Washington and LaGuardia in New York. A DOJ official, made available by the department on condition of anonymity, said the agency believes the divestitures have allowed lower-cost carriers like JetBlue and Virgin America to compete in these markets.

“Our general sense based on the information we have is that the divestitures have had a positive impact,” the official said.

Yet just a year-and-a-half after insisting the settlement would increase competition, the Justice Department in 2015 launched an investigation into possible collusion among the remaining carriers to restrict the number of flights in order to hike ticket prices.

That was another harm the government suit had warned about: “This Merger Would Increase the Likelihood of Coordinated Behavior.”

The investigation is ongoing.

A century ago, amid fears that concentrated corporate power would subvert American democracy, Congress passed a law that prohibited anti-competitive mergers.

“Unless their insatiate greed is checked, all wealth will be aggregated in a few hands and the Republic destroyed,” warned the 1900 Democratic platform of monopolies, echoing the Republican platform that year.

Though the antitrust laws were created in the days of Standard Oil and railroad monopolies, regulators in the modern era have long had concerns about the airline industry.

For decades, the federal government directly regulated fares and routes. Amid runaway inflation in the late 1970s, the industry was deregulated on the theory that market forces would produce lower prices and more efficiency. Still, the father of deregulation, economist Alfred Kahn, argued the new market needed strong antitrust enforcement to preserve the benefits of competition that deregulation was supposed to produce.

The enforcement Kahn envisioned never materialized. The Reagan administration introduced new merger guidelines that were much friendlier to combinations of large corporations. Under the mantra “Bigness Isn’t Badness,” the Justice Department Antitrust Division became much more receptive to claims that efficiencies resulting from mergers outweighed any bad effects.

In the airline industry, despite occasional interventions by antitrust authorities over the years, the number of companies has dropped sharply through dozens of mergers.

Even unconstrained by much antitrust enforcement, airlines have endured as many busts as booms. Their propensity to lose money led Warren Buffett to quip, “If a capitalist had been present at Kitty Hawk back in the early 1900s, he should have shot Orville Wright.”

The Sept. 11 attacks punctured a profitable period in the late ’90s, pushing major airlines into a series of bankruptcies in which workers’ pay and benefits were slashed and companies’ debt was restructured.

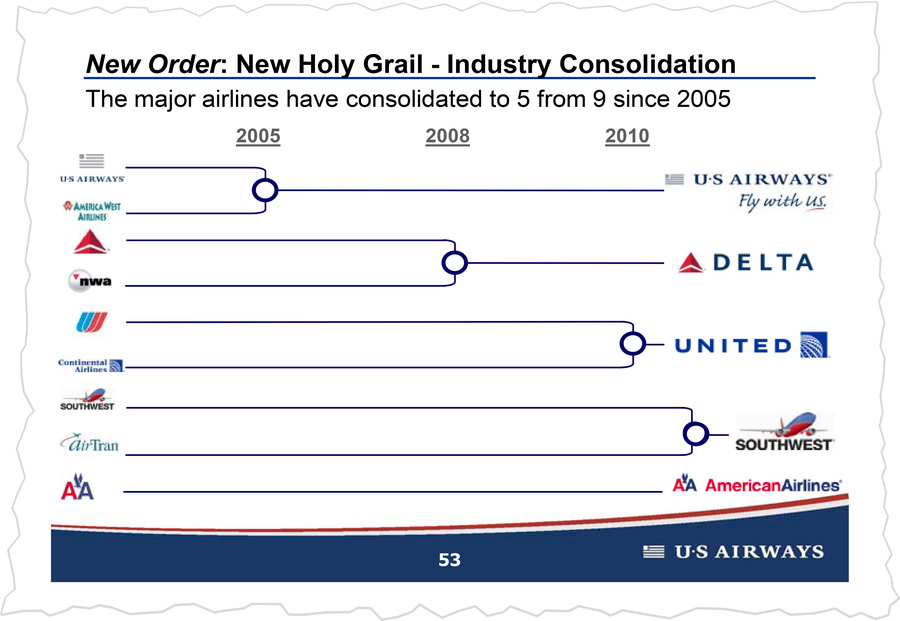

The most recent wave of consolidation began in the mid-2000s. U.S. Airways joined with America West. Delta combined with Northwest. The Obama administration approved the mergers of United and Continental as well as Southwest and AirTran.

In an internal presentation uncovered by government investigators, a US Airways executive called industry consolidation the “New Holy Grail.”

(ENLARGE)

(ENLARGE)Publicly, airlines argued that combining networks would lead to greater choices and more efficiency for travelers, allowing them to fly on a single airline between previously disconnected cities.

“Consumer demand is the driver for this combination,” then-US Airways CEO Doug Parker told Congress while pushing the merger with American Airlines in early 2013. “Airline passengers want broader networks, capable of getting them to more places more efficiently.”

But sifting through millions of pages of airline documents, Justice Department lawyers and economists found evidence instead that airline executives coveted the market power that mergers could deliver.

“Consolidation has also helped with capacity discipline,” Scott Kirby, who became president of the new American Airlines, said at a conference in the run-up to the merger. “And it has allowed the industry to do things like ancillary revenues; again, hard to overstate the importance of that.”

Capacity discipline is an industry term for limiting the number of available seats or flights, which in turn allows for higher fares. Ancillary revenue – which has ballooned in recent years – comes from fees airlines charge for checked bags, different levels of seating, and food.

The government identified more than 1,000 routes in which American and US Airways competed head-to-head. The merger would significantly increase the level of concentration on those routes, which could lead to higher fares, the complaint argued.

The Justice Department’s concerns were not just about prices. It was also worried that the American-US Airways merger would lead the combined company to reduce service or jettison plans for more routes.

Following previous mergers, airlines had cut hubs, especially in mid-sized cities away from the coasts. Such cuts could devastate already struggling communities.

“Surely these guys aren’t really planning to keep Cleveland open,” wrote Parker, now the American CEO, in a 2010 e-mail to other executives, commenting on the pending merger between United and Continental. “I’m hopeful they’re just saying what they need to . . . to get this approved.”

United even signed an agreement with the state of Ohio designed to guarantee the airline’s commitment to Cleveland, which had been a Continental hub before the merger. But four years later, United did just what Parker predicted, slashing more than half of its flights from Cleveland. Delta made similar cuts in Cincinnati and Memphis after its merger with Northwest.

After studying the industry, government investigators also concluded that American Airlines and US Airways were well able to survive on their own. US Airways had reported record profits in 2012. American had managed to cut labor costs after declaring bankruptcy in 2011. It was during the bankruptcy process that US Airways executives had proposed a merger, but American executives initially resisted the idea, drafting a standalone plan they believed would lead to sustained profitability.

“There is no reason to accept the likely anti-competitive consequences of this merger,” the government’s complaint said. “Both airlines are confident they can and will compete effectively as standalone companies.”

Teams of lawyers and economists spent months in the run-up to the lawsuit dueling behind closed doors over whether the merger would benefit or harm consumers.

After the Justice Department filed its complaint in federal court in Washington, the judge quickly issued a protective order sealing much of the case. Such secrecy is common in antitrust cases because companies say they want to protect proprietary business information.

Still, a picture of the case emerges in documents obtained by ProPublica through public records requests and interviews with players on both sides.

The DOJ’s Antitrust Division assigned roughly 30 lawyers and economists to work on the case. They faced off against an “army” at least four times that size, one government lawyer recalled. The airlines assembled top antitrust attorneys from five separate law firms, virtually all of whom had previously worked as government antitrust enforcers.

American Airlines’ general counsel later estimated the company had spent $275 million on outside lawyers for its bankruptcy and to defend the merger suit. That doesn’t include US Airways’ spending on the deal.

To handle the trial, the airlines hired Richard Parker of O’Melveny and Myers, a famously aggressive litigator and former high-ranking antitrust official at the Federal Trade Commission.

“I told you he wasn’t here to play around,” one government lawyer wrote in an e-mail to a colleague the day the complaint was filed, after Parker arranged to come in to meet DOJ lawyers at 10 a.m. the next day.

The airlines also hired a team of over 30 economists from a consulting firm headlined by two academics who had previously done stints as the Justice Department’s chief antitrust economist.

The economists created complex models designed to demonstrate that the merger would, in fact, create wide-ranging benefits for flyers and actually increase competition.

The Justice Department’s economists created their own models, coming to the opposite conclusions. It’s impossible to compare the models as they remain under seal.

As the teams worked late nights and weekends in the mad dash to prepare for a November 2013 trial date, the airlines opened a second front against the lawsuit, working through political channels rather than legal ones.

The leadership of the Antitrust Division has long said it is insulated from political pressure and that cases are strictly law enforcement matters, but the airlines clearly felt differently.

At the center of the companies’ lobbying effort were high-profile Democrats particularly well positioned to influence the Obama administration.

Jim Millstein, the financial adviser on the deal who had left a high-level Treasury Department role in 2011, was dispatched “to assure the DOJ of our commitment to the consumer benefits we outlined in our case and our willingness to consider very significant concessions,” American Airlines said in a statement. Millstein had four in-person meetings, a phone call, and some e-mail correspondence with his friend, Deputy Attorney General Cole.

Millstein said the first meeting, which came two weeks after the lawsuit was filed, was “maybe a 30-second conversation between us. The subsequent conversations were equally non-substantive, just my checking in with him at points when the settlement discussions seemed to have stalled to reiterate that my guys were serious about reaching a settlement.”

The CEOs and lobbyists for both airlines were talking with Mayor Emanuel starting just six days after the lawsuit was filed up through the settlement, e-mails show.

American Airlines CEO Doug Parker called the letter from Emanuel and other mayors to the Justice Department, which Emanuel’s staff gave to Politico, “incredibly helpful” and one of the most important elements of the airlines’ pushback against the government.

The letter made a broad public interest argument, arguing for the deal “based on growth which benefits consumers and our communities.” But e-mails among Emanuel’s staff suggest he needed something from the airlines in return: help with a project to overhaul and update O’Hare International Airport.

One e-mail refers to the mayor planning to seek “commitments” from the incoming American Airlines CEO at Emanuel’s lunch with him at the St. Regis in Washington. (The hotel meeting was first reported by the Chicago Tribune.)

It’s not clear what, if anything, Emanuel ultimately received in return for advocating for the American-US Airways merger. The city redacted portions of e-mails in which the mayor’s aides discussed the matter.

A spokesman for Emanuel declined to comment on the mayor’s conversations with the airline CEOs or on whether Emanuel raised the merger with Obama administration officials. “City officials wanted to ensure that the airline continued to be a good partner to the city, and that the residents of Chicago continued to benefit from the jobs and economic opportunities that the company provided,” the spokesman said.

A few months after the Justice Department settled its case, Parker and other American Airlines executives became first-time donors to the mayor, contributing $53,000 to his re-election campaign.

On Capitol Hill, American and US Airways hired both Democratic and Republican lobbying firms, and 183 members of Congress ultimately came out in favor of the deal.

Though one of American’s core arguments for the merger was that the company needed to grow to compete more aggressively with Delta and United, the chief executives of those companies came out in support of the deal and further industry consolidation.

A lobbyist for Airlines for America, the industry trade group, also pushed for it in settlement talks with Florida’s attorney general, e-mails show. Antitrust observers say the industry-wide support reflects the idea that, post-merger, reduced competition would benefit all airlines.

Organized labor often opposes mergers because the “efficiencies” touted by Wall Street can be a euphemism for job cuts. But in this case, US Airways executives won the backing of the American Airlines pilot, flight attendant, and mechanics’ unions in exchange for promises of better contracts.

Flight attendants union chief Laura Glading was the most active labor figure campaigning for the deal, crisscrossing the country to meet with editorial boards and state attorneys general who had joined DOJ’s suit. Appearing at a Capitol Hill rally in her flight attendant uniform, she offered a different perspective and image than the company executives in business suits.

Hilary Rosen, one of the Democratic lobbyists working on the deal, later credited the union support with flipping the Justice Department.

While labor was the friendly face of the merger, Tom Horne, the former Arizona attorney general, who is now out of politics, said that he experienced an uglier side of the campaign.

Horne, a conservative Republican, invoked Adam Smith’s The Wealth of Nations in explaining why he joined the Obama administration in challenging the deal. Soon after the complaint was filed, Horne says his political consultant was told by a lobbyist that $500,000 would be spent on ads against Horne in his upcoming primary if he didn’t drop the suit.

A former Horne staffer gave the same account. The case was settled before the primary campaign got underway. American Airlines and the lobbyist denied they had threatened to attack Horne.

Horne said the promised political retribution shocked him. “Nothing remotely like that ever happened before or after,” he said. “I was in statewide office for 12 years.”

When the Justice Department moved to drop the case, Horne felt he could not continue to contest the merger on his own. His office didn’t have the resources to go up against two giant companies.

The first public indication that the Justice Department’s resolve was weakening came in early November, just three weeks before the trial was set to begin. Attorney General Eric Holder was asked about the case at an unrelated press conference. “We hope that we will be able to resolve this short of trial,” he said.

The comment caught many observers by surprise. One lawyer involved in the case called it “bizarre” for the attorney general to publicly signal his support for a settlement in the midst of negotiations.

Holder, now out of office and working at a law firm, declined to comment.

A week after Holder’s comments, the Justice Department announced it was dropping the case in exchange for modest concessions.

Antitrust observers were shocked at the gulf between the remedy and the concerns outlined in the original complaint.

Before the merger, the two airlines controlled more than two-thirds of all takeoff and landing rights at Reagan National Airport. The settlement required the combined company to give up less than 15 percent of the slots at the airport along with others at New York’s LaGuardia, which ultimately went to JetBlue and other airlines.

When the government filed its suit, the Department of Justice’s top antitrust official had been asked about the possibility of a settlement centering on Reagan National. He had dismissed it as insufficient. The airlines “want to fly where they fly without competition,” said Bill Baer, an assistant attorney general in the Justice Department’s antitrust division. “This merger would facilitate that, regardless of whether you have an issue at Washington National or not.”

Asked about why the government made the deal it did, a DOJ official told ProPublica, “We ultimately agreed to settle because they gave us what we and what our airline experts at the division believed was a very, very good settlement.”

In the three years since the DOJ settlement, American has slowly worked to integrate US Airways’ operations into its own. While that process still hasn’t finished, it’s possible to take some stock of what’s happened, both to the main players and to consumers.

The combined company has 10 percent more employees than it had at the time of the merger and the two companies’ CEOs, Doug Parker and Tom Horton, each received over $15 million in bonuses for completing the deal.

Glading, the flight attendants union chief who was the face of labor support for the merger, quit last year and went to work as a consultant for American, a move the union blasted as a “disgusting betrayal.” She’s since taken a job at the Federal Aviation Administration and did not respond to requests for comment.

The union launched an investigation into whether Glading cut side deals with the company and some members have called her support for the merger tainted.

The union of mechanics and ground workers recently came to an agreement with American giving its members a large pay raise. The pilots union, meanwhile, complained in a letter to management earlier this year of “the rebirth of the toxic culture we fought so hard to eradicate.”

The post-merger American has increased fees across the board. The fee for a child traveling alone, for example, was $100 each way pre-merger. Today American charges $150, not only for children 11 and under as it did before, but also those aged 12 to 14.

The industry has been raising fees for a decade, so it’s difficult to say how the merger affected the rate of such increases. But American brought in $4.6 billion in ancillary revenue (fees and sales of frequent flyer miles) in 2014, well more than the $3.1 billion American and US Airways earned the year before the deal, according to the research firm IdeaWorks.

American has also overhauled its frequent flyer program to make it more difficult to earn miles, in line with the other remaining major carriers.

The Justice Department’s complaint predicted the merger would prompt the end of US Airways’ Advantage Fares program, which competed with other carriers’ lucrative nonstop routes by offering aggressively discounted one-stop options. The program allowed flyers to save hundreds of dollars on, for example, the Miami-to-Cincinnati route.

Sure enough, American Airlines killed the Advantage Fares program earlier this year before bringing it back on “selected routes where it makes business sense to do so.”

While pushing for the deal in 2013, economists hired by American projected that, by offering more and better route options, consumers would see $500 million in annual benefits from the deal.

American’s statement acknowledged the airline has not studied if these predictions have come true.

The company also said in a court filing that “thousands” of new routes would be created. Today, American says there are just 1,600. And it’s not clear these are routes many travelers actually want to fly.

“Markets such as Dubuque-to-Yuma that customers cannot get to on either American or US Airways today, they will now be able to connect efficiently on,” Parker, now the American CEO, said while touting the deal on Capitol Hill. “Those are real efficiencies that drive the majority of the synergies.”

A recent ticket search shows the new American does indeed offer service between Dubuque, Iowa, and Yuma, Arizona.

But all of the available flights involve two stops at hubs in Chicago and Phoenix and last at least eight hours. Almost no one seems to have flown that route.

According to a Department of Transportation database that includes a 10 percent sample of airline tickets, just five passengers have booked flights from Dubuque to Yuma in the years since the merger.

–

Reporting contributed by Jesse Eisinger and Olga Pierce.

–

Justin Elliott is a ProPublica reporter covering politics and government accountability. To securely send Justin documents or other files online, please visit our SecureDrop site.

–

Have information about the airlines or another antitrust matter? Please e-mail justin@propublica.org.

–

Previously in the American-US Airways merger:

From The [Wednesday] Papers, Nov. 13, 2013:

All-American Airlines

“American Airlines and US Airways struck a settlement with the U.S. Justice Department that will allow the airlines to complete a $17 billion merger and create the world’s largest carrier, the airlines announced Tuesday,” the Tribune reports.

The Justice Department had opposed the merger because it would further consolidation in the airlines industry, which would be bad news for consumers because of less competition, resulting in higher fares and fees.

Under terms of the settlement, however, the new super-airline will actually give up gates at airports around the country, opening up opportunities for new, upstart airlines to get slots that were previously reserved for American or US Airways. In other words, a merger creating the world’s largest airline would actually result in more competition.

Or so the theory goes.

“The deal, which heads off a trial planned later this month, calls for the combined airline to give up some takeoff-and-landing slots and some airport gates, including two American Airlines gates at Chicago O’Hare International Airport.”

Two? Two lousy gates?

“Although the combined airline will lose two gates in concourse L at O’Hare, airline officials are optimistic they will be able to reconfigure existing gates to gain back a gate or two, said Andrew Nocella, US Airways senior vice president of marketing and planning.”

So, essentially, the new super-airline is giving up nothing. Nice negotiating, Justice!

“‘It’s not going to have a material impact on our ability to fly what we were intending to fly,’ said Doug Parker, CEO of US Airways and incoming CEO of the combined airline.”

Once again, I invite the Obama administration to my place this Friday night for poker. I’ll even spring for the beer.

*

“[The deal] also requires the combined airline to maintain Chicago and other airports as hubs for at least three years, something executives said they intended to do anyway and will keep long past three years.”

The deal also requires the combined airline to continue using wings on its planes for at least three years, which the Justice Department counted as a major victory.

*

Four airlines will now control 80 percent of the market, according to the Justice Department.

Yet, U.S. assistant attorney Bill Baer called the deal a “game-changer” that will likely drive down airfares.

“It will disrupt today’s cozy relationships among the incumbent legacy carriers,” he said.

Except what will now be the coziest relationship among incumbent legacy carriers ever – the merger of American and US Airways!

“[It will] provide consumers with more choices and more competitive airfares,” he said.

Two big airlines into one hardly provides consumers with more choices; the slot give-backs might go to a low-fare carrier or two, but that will hardly dent the market.

The only ones getting more choices will be American and USAir executives, who will now have to decide whether to buy new mansions or knock down and rebuild the ones they already have.

*

“There is no doubt that in markets where a merger reduces two competing airlines to one monopoly, fares increase,” the Wall Street Journal reported in August.

“In April, the Middle Seat crunched data to show that some big-city routes saw price increases of 40% to 50% or more after mergers reduced competition.

“Between Chicago and Houston, the home bases of United and Continental, the average fare in the third quarter last year was 57% higher than the same period three years earlier, before those airlines merged. Over the same period, United’s average domestic fare was up 16%.”

Posted on October 12, 2016